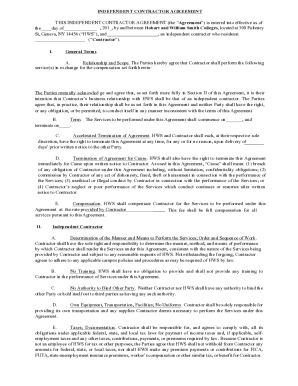

In using an independent contractor agreement template you ensure that everyone at your startup who is part of the recruitment process uses a consistent and legally defensible document. Some provisions may need to be altered in accordance with local law.

This template favors the companyclient and should be edited to reflect the particulars of the deal for which it is used.

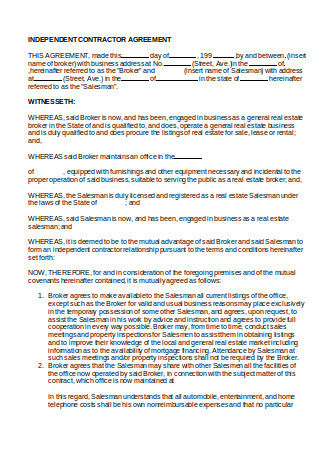

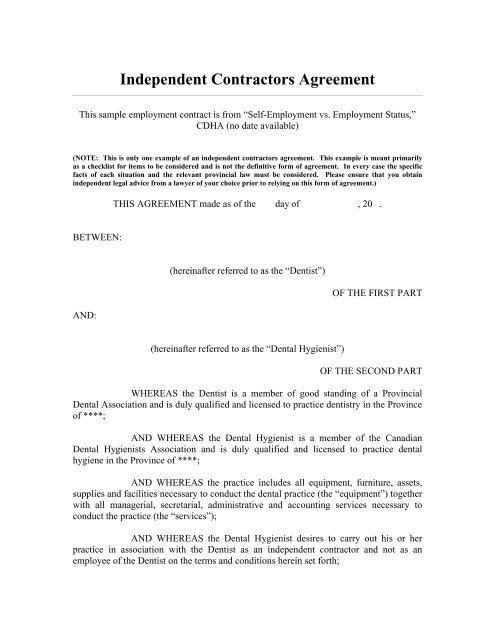

Independent contractor employee agreement template. An independent contractor agreement is an agreement between two parties the independent contractor often called just the contractor and the recipient of services often called just the recipient. Independent contractor agreement template this agreement governs the relationship between a company and an independent contractor. An independent contractor agreement also known as a 1099 agreement is a contract between a client willing to pay for the performance of services by a contractor.

Download 10 free independent contractor agreement templates to help yourself in preparing independent contractor agreement. In this document the parties are generally forming a relationship so that the contractor can perform one specific task. Sample template startups can streamline the hiring process with an independent contractor by using a standardized agreement.

Independent contractor agreement template here is an independent contractor agreement template that contains contract language beneficial to both your company and to the independent contractor you hire. It can be used by businesses seeking independent contractors and the subcontractors solopreneurs or freelancers working for them. You can also explore services contract templates to see more options.

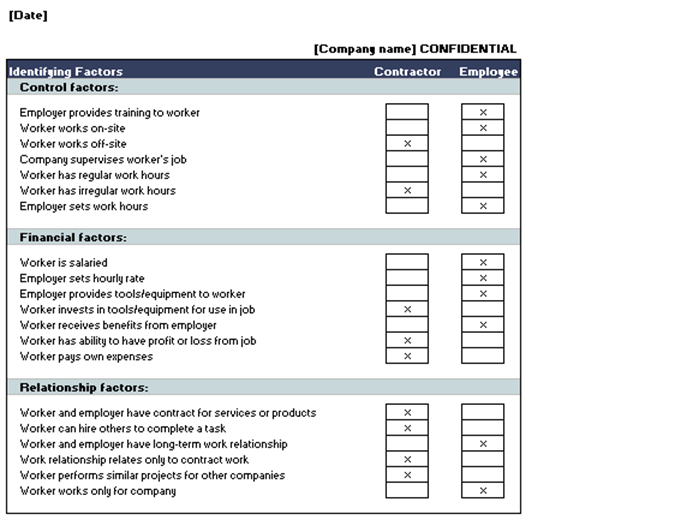

In its capacity. Unlike an employee an independent contractor cannot be managed by the employer except within the context of their agreement. Contractor is an independent contractor and neither contractor nor contractors employees or contract personnel are or shall be deemed clients employees.

An independent contractor is a person who runs his own business and provides services to other individuals and companies without working directly for any employer. An independent contractor agreement allows the hiring company and the contractor to detail what is expected and why the contractor is not an employee for legal and tax purposes. Client will not require contractor to rent or purchase any equipment product or service as a condition of entering into this agreement.

These relationships are very different than employment relationships. A written contract between two parties an independent contractor agreement is used for a specific service or projectto complete a task or project one company hires another company for a short period using an independent contractor agreement. Understanding independent contractor agreement.

As a general rule the irs treats independent contractors as self employed and their earnings are subject to self employment taxes. An independent contractor is a self employed professional who works under contract for an individual or business their client. In other words the contractor makes their own hours and decides how to carry out their.

In accordance with the internal revenue service irs an independent contractor is not an employee and therefore the client will not be responsible for tax withholdings.

0 Response to "Independent Contractor Employee Agreement Template"

Post a Comment