This includes but is not limited. In accordance with the internal revenue service irs an independent contractor is not an employee and therefore the client will not be responsible for tax withholdings.

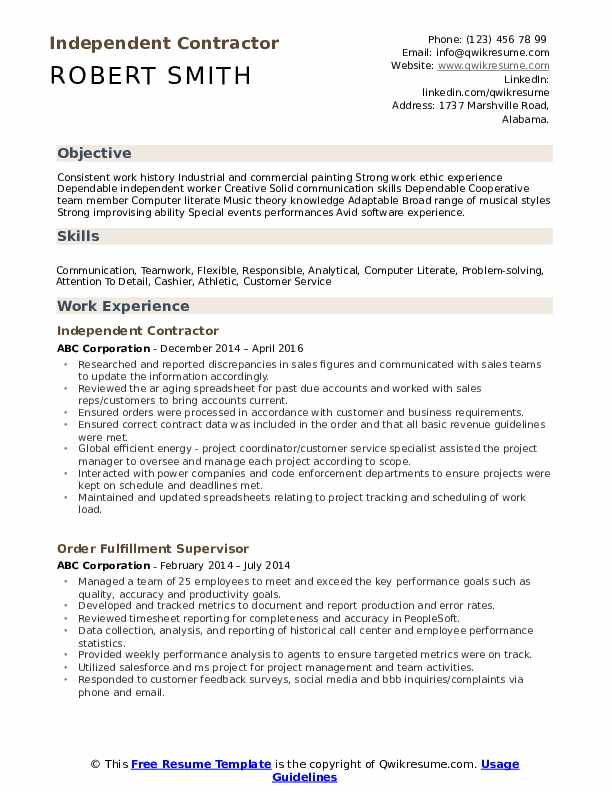

Identifying the right contractor is half the battle won.

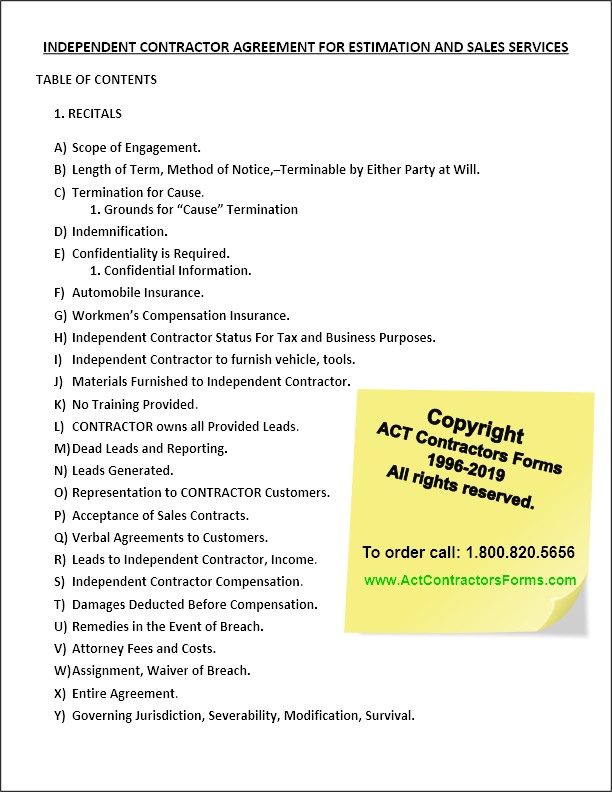

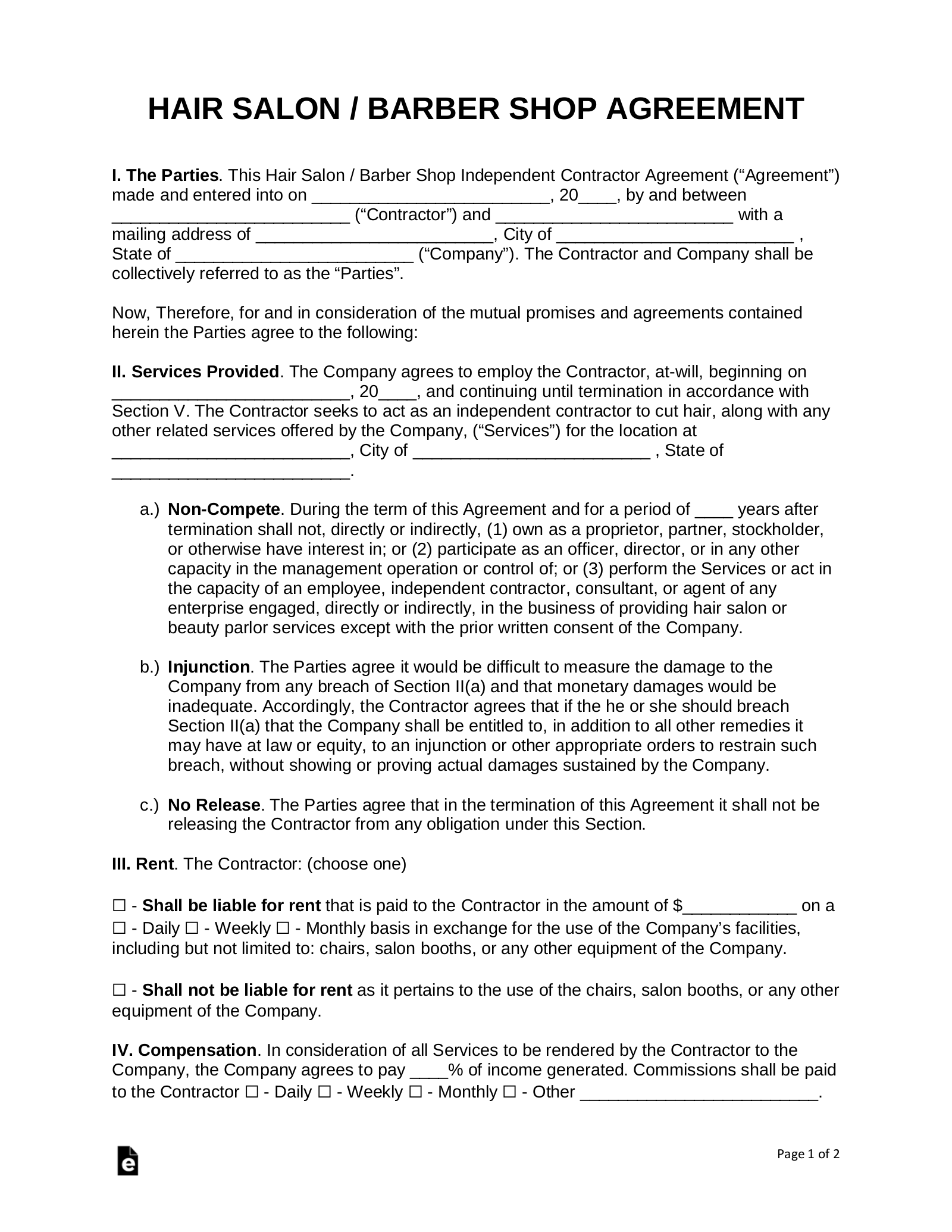

Independent contractor sales agreement template. The next thing you have to do to convince the professional to accept your deal is to create a contractor agreement template. A simple agreement between a company and an independent contractor independent contractor agreement is usually used when a company or an individual is hired to a short term task or a specific project. It is important to keep in mind that it is hard for people to work without solid contracts these days.

The client will have no responsibility for employees subcontractors or personnel in connection with the services provided. Furthermore the company will not provide retirement or any other benefits customary to employment. 16 sample independent contractor agreements.

An independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for payment. An independent contractor agreement also known as a 1099 agreement is a contract between a client willing to pay for the performance of services by a contractor. Duties of sales agent agent will carry out the customary duties of a sales representative.

Independent contractor agreement this contract is made as of the day of 20 between company name insert dba or common name a corporation or other business type incorporated under the laws of insert state and having its principal place of business at insert address the company. The company will not be responsible for filing or paying any local federal or state taxes.

0 Response to "Independent Contractor Sales Agreement Template"

Post a Comment