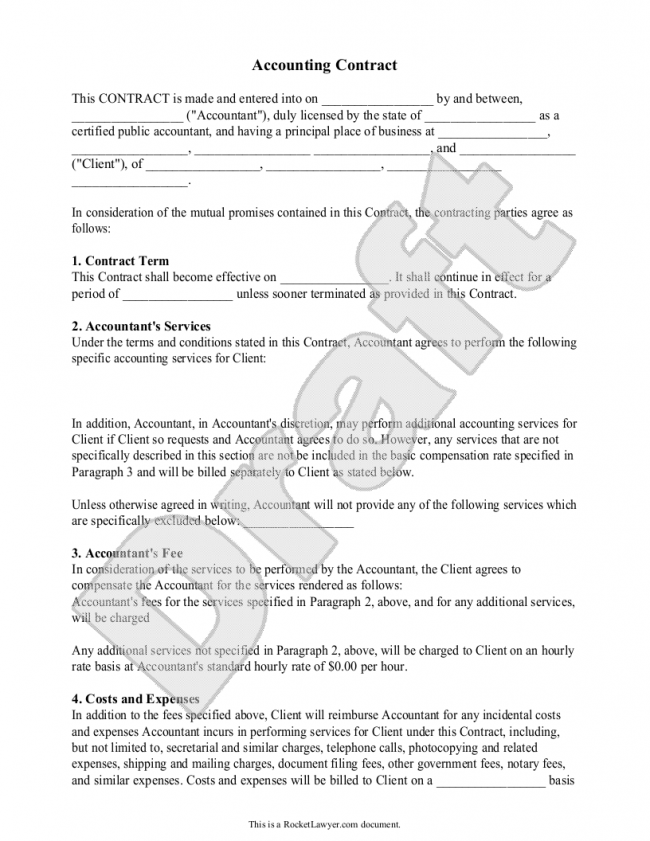

It also sets out the accountant is an independent contractor and not an employee. An independent contractor agreement for accountant and bookkeeper is an important document to determine for tax purposes that the worker is not an employee of the company.

The client will have no responsibility for employees subcontractors or personnel in connection with the services provided.

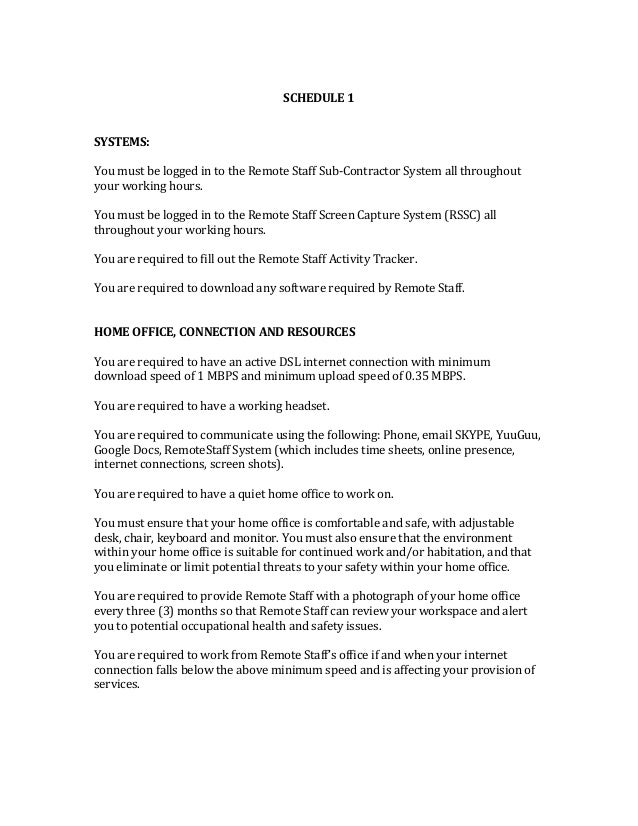

Independent contractor agreement accountant template. Click on a heading for articles in this article i first discuss when an accountant is a contractor as opposed to an employee. No article or amendment to this agreement shall be taken to imply or create a partnership joint venture or employeremployee relationship. The accountant will have to sign the blank line labeled accountants signature then producing the.

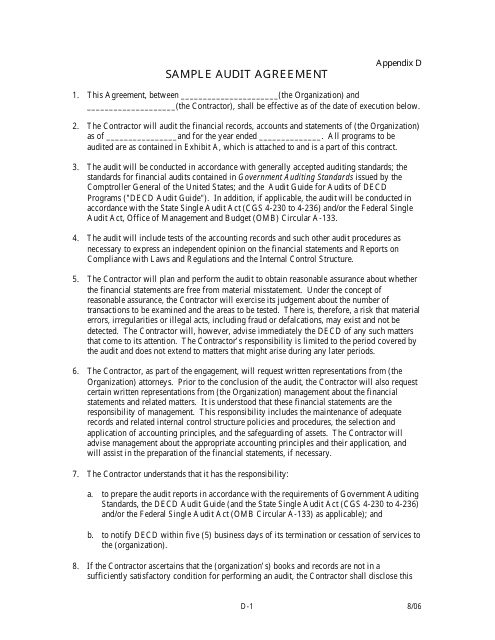

As an independent contractor the accountant will be solely responsible for paying any and all taxes levied by applicable laws on its compensation. This accounting services agreement is between a clientcompany and an accountant who will render audit or accounting services. Home employment contract agreement independent contractor agreement template bookkeeping accounting services agreement.

Designed to create a clear set of expectations for the working relationship the agreement covers. An independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables compensation and any additional clauses. Independent contractor the accountant shall provide the services as an independent contractor and shall not act as an employee agent or broker of the client.

In witness whereof contractor has executed this agreement and company. Free template and instructions provided. Their only obligation will be to pay the independent contractor with no liability if anyone should get injured during the performance.

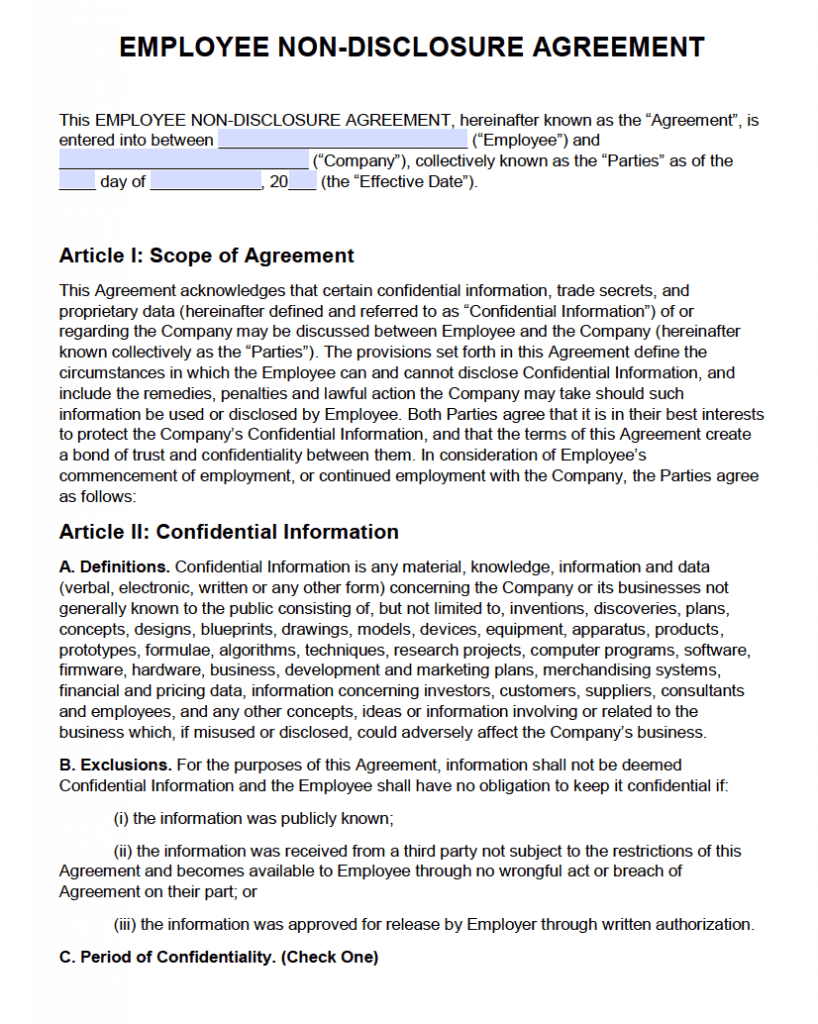

Second i look at the essential terms of an accountant employment contract and an accountant independent contractor agreement. This accounting contract template can be customized in minutes and includes electronic signature fields for you and your client. Accountant employment and independent contractor agreements.

Will contain enough room for both the accountant and the client to formally enter this agreement. Agreement understands its terms and agrees that in consideration for their employment or continuing employment training with company and any other consideration recited herein they will be bound by the terms covenants and restrictions set forth in this agreement. An independent contractor agreement is between a client and a company that makes a promise to produce services in exchange for payment.

Provider shall be considered an independent contractor at all times. Everything you need to know. Independent contractor agreement for accountant and bookkeeper.

Independent contractor agreement for accountants and bookkeepers for firm protect your interests with this independent contractor agreement when youre hiring an accounting or bookkeeping service. This agreement clearly sets forth the services to be performed and payment for such services.

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

0 Response to "Independent Contractor Agreement Accountant Template"

Post a Comment