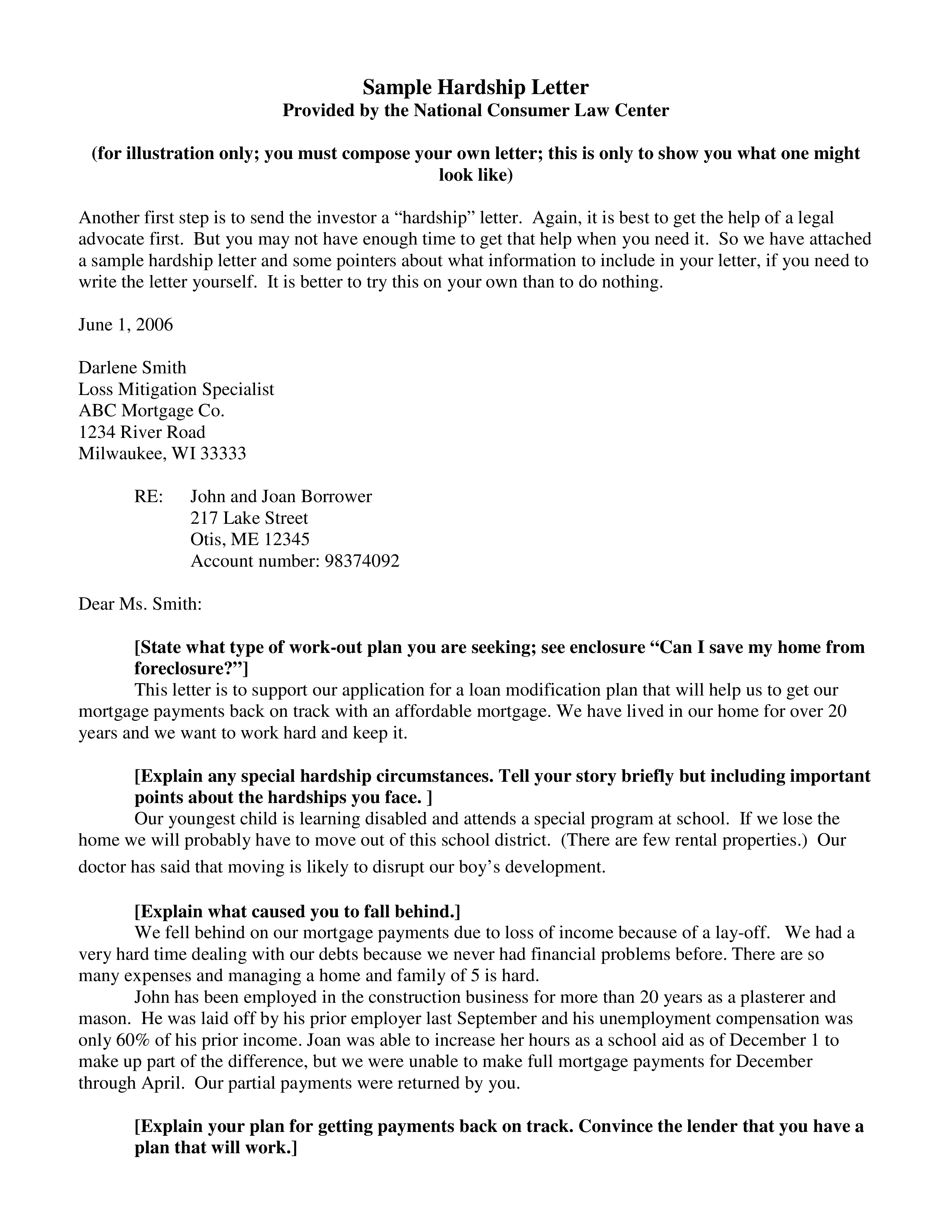

Be clear with as much detail as possible such as dates account numbers transaction ids etc. Three words of advice for strong mortgage letters of explanation.

Sometimes lenders also ask for a letter of explanation for mortgage to ask for clarification on.

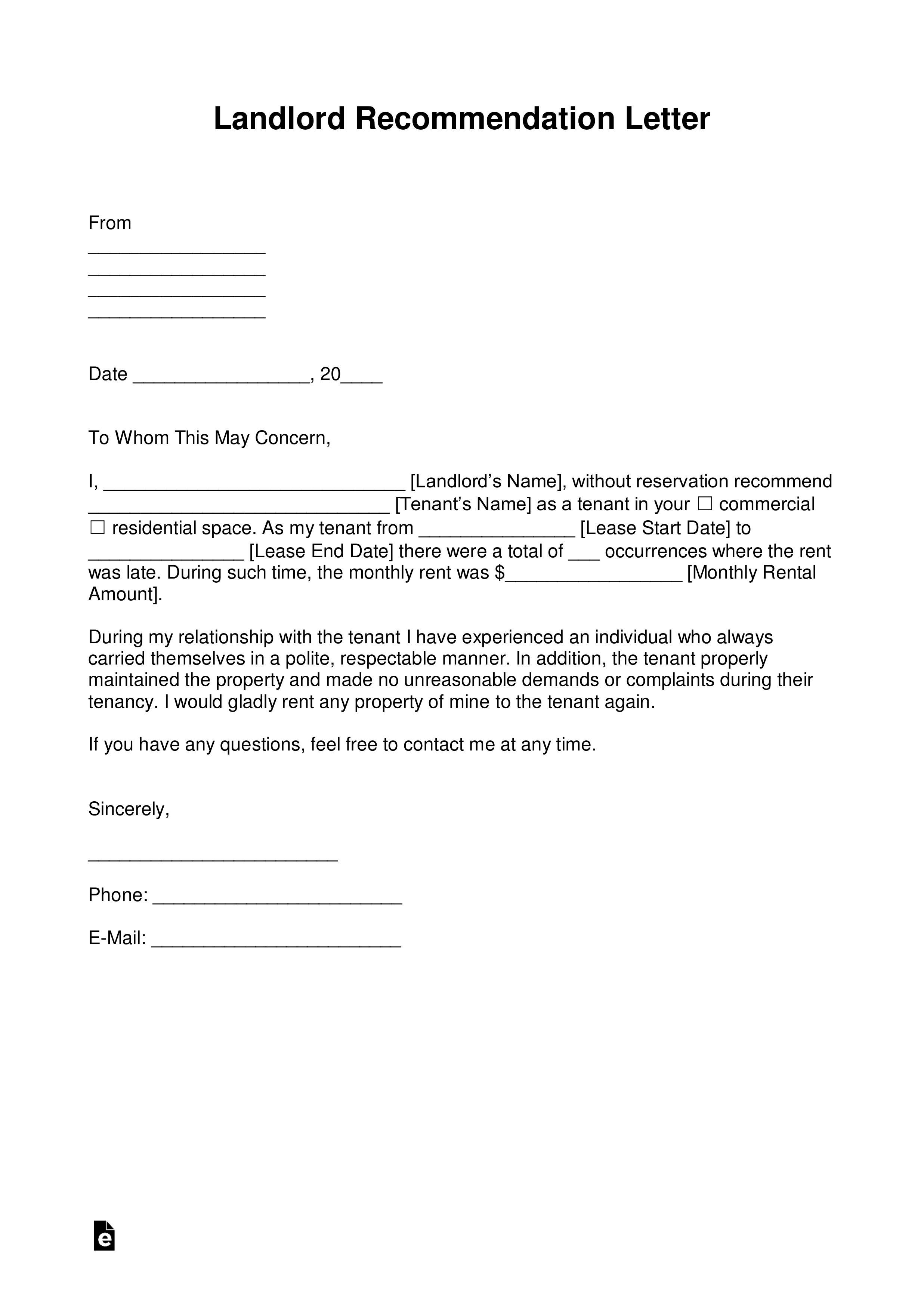

Letter of explanation template for mortgage loan. The purpose of this letter is to provide information needed to make a decision about your loan. They actually contain critical details for lenders who must follow strict underwriting requirements in order to approve home loans backed by government agencies and mortgage investors. This article on how to write a good letter of explanation for underwriters was written by gustan cho nmls 873293 letter of explanations will be common during the mortgage process.

Some borrowers panic when an underwriter asks for such a letter because they think the loan is going to be denied. If youre currently going through the joyful process of obtaining a home loan you may have been asked to furnish a letter of explanation or loe to provide a little more color to what the underwriter might feel is a complicated matter. Letters of explanation arent just arbitrary mandates intended to make your mortgage application longer and more confusing.

Simple short and informative. Its common for mortgage underwriters to ask for a written explanation for certain situations or problem areas in your credit history employment or other areas. Demystifying the loan approval maze www.

For instance a lender may ask for a letter of explanation for derogatory credit before he allows you to borrow money. The letter of explanation or loe for short is a common part of the mortgage underwriting and documentation process. A letter of explanation makes getting approved for a mortgage more cumbersome but its a positive sign.

Fortunately when your loan officer or an underwriter requests a letter of explanation it doesnt have to be a big stress moment. What is a letter of explanation. A letter of explanation is a short document you would send to a recipient such as a lender.

If you need the services of a mortgage broker to help get your loan approved then please call us on 61 2 9194 1700 or complete our free assessment form to speak with one of our experienced credit specialists. Most borrowers freak out after they get a conditional loan approval and part of conditions are a bunch of letter of explanations that need to be provided. When a lender requests a letter of explanation it is giving you the opportunity to share.

0 Response to "Letter Of Explanation Template For Mortgage Loan"

Post a Comment