Limited partnerships are subject to a state franchise tax. Llps are governed by state law and must be registered with a state office.

Business partners might assume they agree on everything but sometimes theyre wrong.

Limited liability partnership agreement template texas. A partnership also known as a general partnership is created whenever two or more people agree to do business together for profit even if there is no intent or written agreement to form a partnership. A limited liability partnership shields you by limiting how much you can lose because of your partners mistakes or negligence. A written agreement clarifies how a limited liability partnership works.

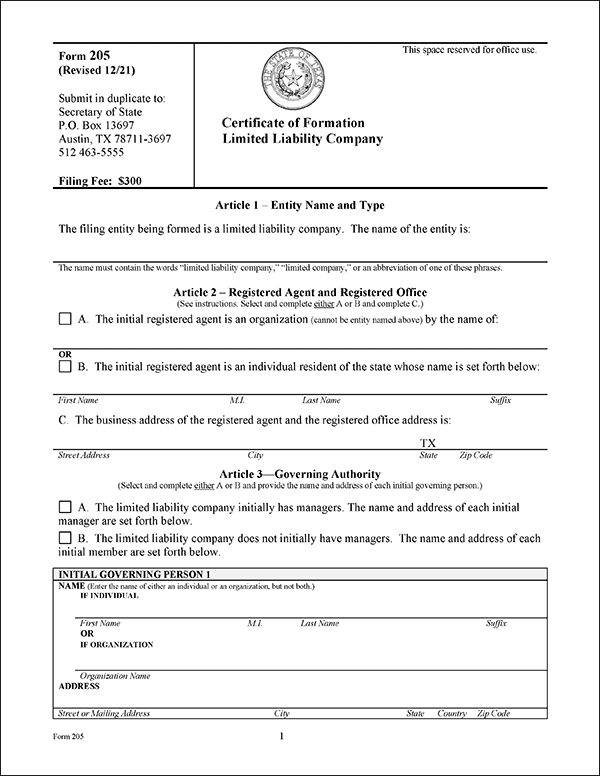

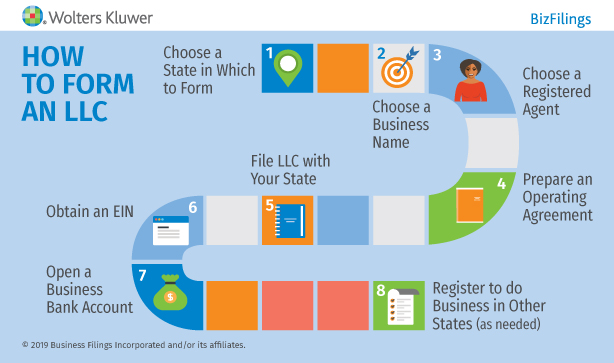

Partners may be individuals partnerships corporations and any other type of legal entity. Here are the steps to form a limited liability partnership llp in texas. A partnership agreement is an internal written document detailing the terms of a partnership.

A partnership is a business arrangement where two or more individuals share ownership in a company and agree to share in the profits and losses of their company. Here are the steps you should take to form a partnership in the state of texas. They are often formed by licensed professionals like attorneys accountants or physicians because they generally protect each individual partner from liability for the professional malpractice of all other partners.

The general partners control the operation of the business on a day to day basis. Section 96 limited liability of limited partners. In this article we discuss the pros and cons of an llp and provide a template limited liability partnership agreement that you can use to set up your own llp.

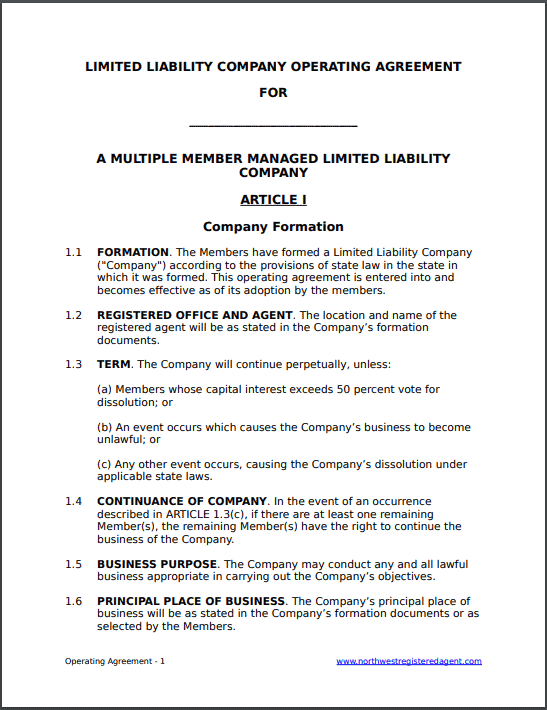

In a limited partnership there will be one or more general partners and one or more limited partners. An llp is a licensed partnership that protects partners from personal liability resulting from the operation of their business. The boc does not expressly require that a texas limited liability company have a company agreement but it is difficult to conceive of a situation in which there would not be some skeletal agreement of the members regarding the conduct and affairs of the limited liability company.

A texas limited partnership consists of an agreement between at least two partners one of whom must be designated as a general partner and another designated as a limited partner. Partnership agreement and file a certificate of formation with the secretary of state. And that he executed and swore to the above limited partnership agreement as a limited partner on the day and year therein mentioned for the intent and purposes therein.

Download your free partnership agreement template. A texas llc company agreement is a legal document to be used by entities of any size that would like to establish the companys procedures and policies among other basic and detailed aspects of the companyalthough the document is not a requirement of the state to conduct business within the state of texas all membersowners establishing businesses should carefully consider the placement. A limited partner shall not be liable for the debts liabilities contracts or any other obligations of the partnership.

0 Response to "Limited Liability Partnership Agreement Template Texas"

Post a Comment