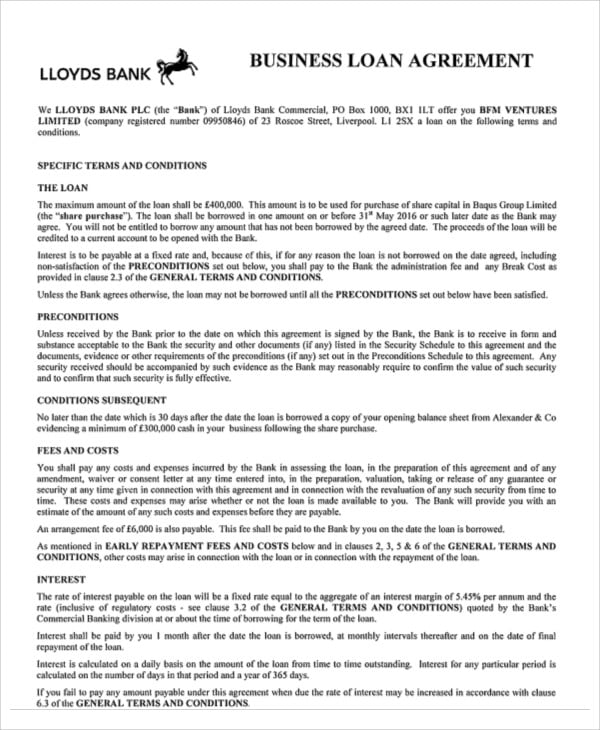

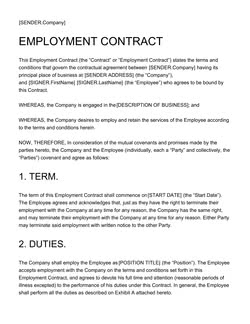

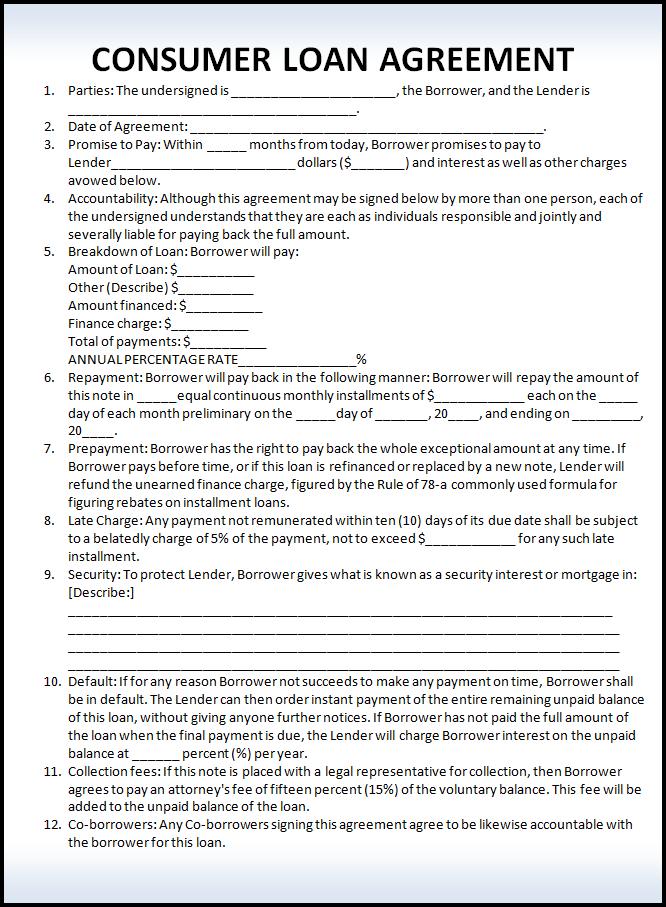

A legally binding loan agreement not only maps out the terms of the loan but it also protects you if the borrower defaults on the loan. In this loan agreement the person or entity lending the money will be called the creditor while the person or entity borrowing the money will be called the debtor.

The lender provides a sum of money you repay according to an agreed upon schedule and if something goes wrong each of you has rights and.

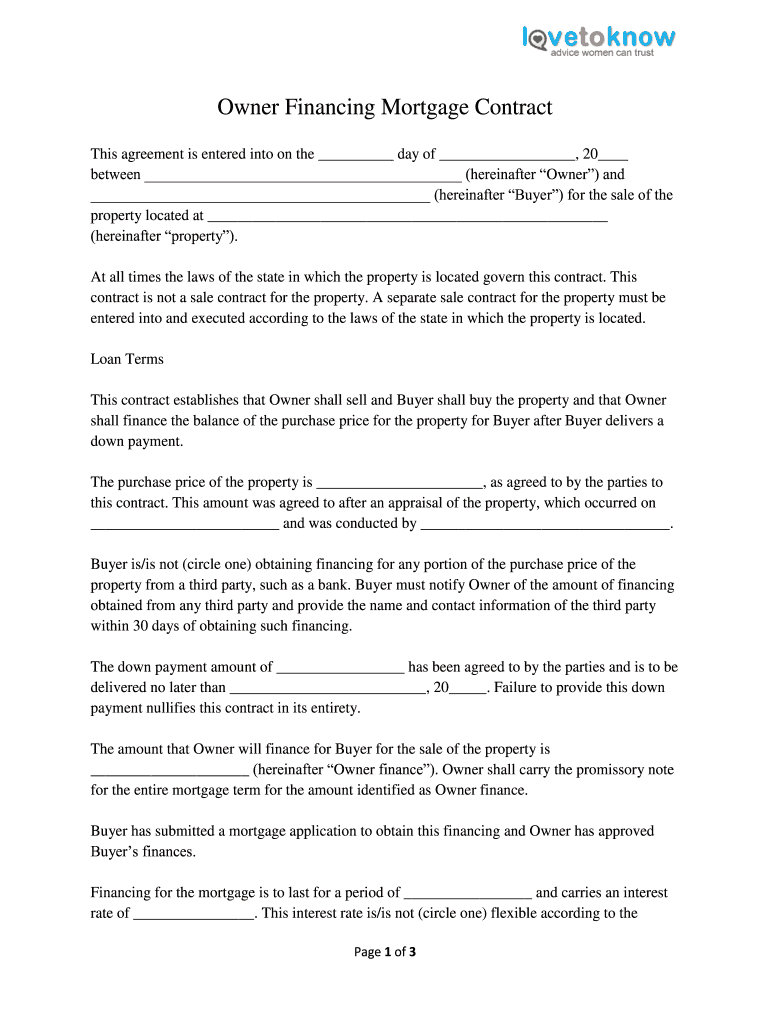

Loan terms and conditions template. Loan terms can also be the characteristics of your loan which your loan agreement describes. A loan agreement is a written promise from a lender to loan money to someone in exchange for the borrowers promise to repay the money lent as described by the agreement. 22 repayment of loan.

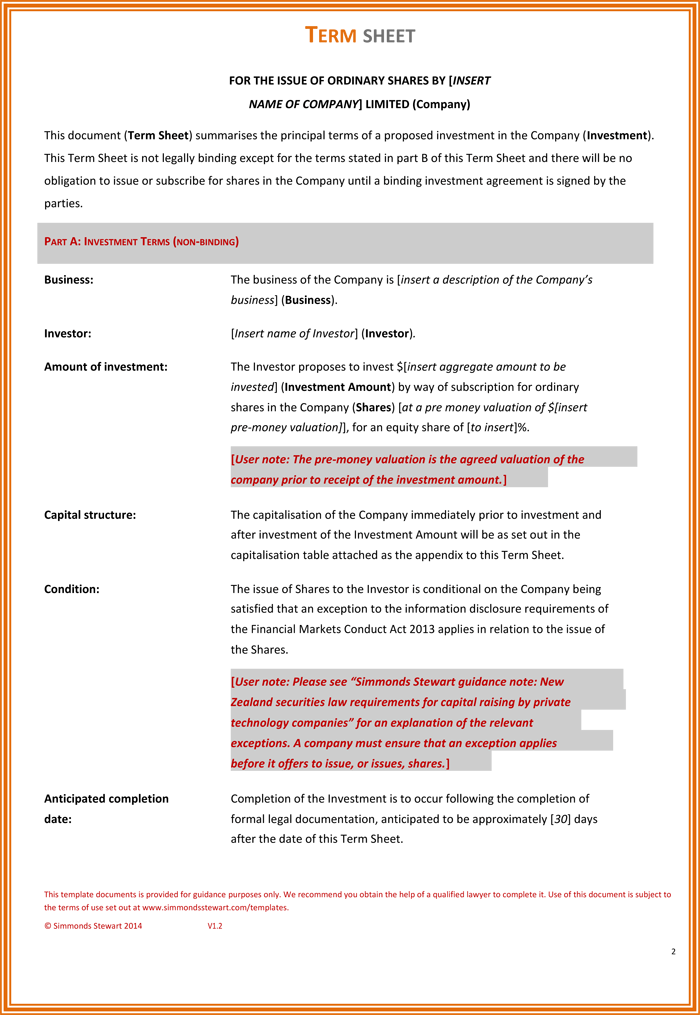

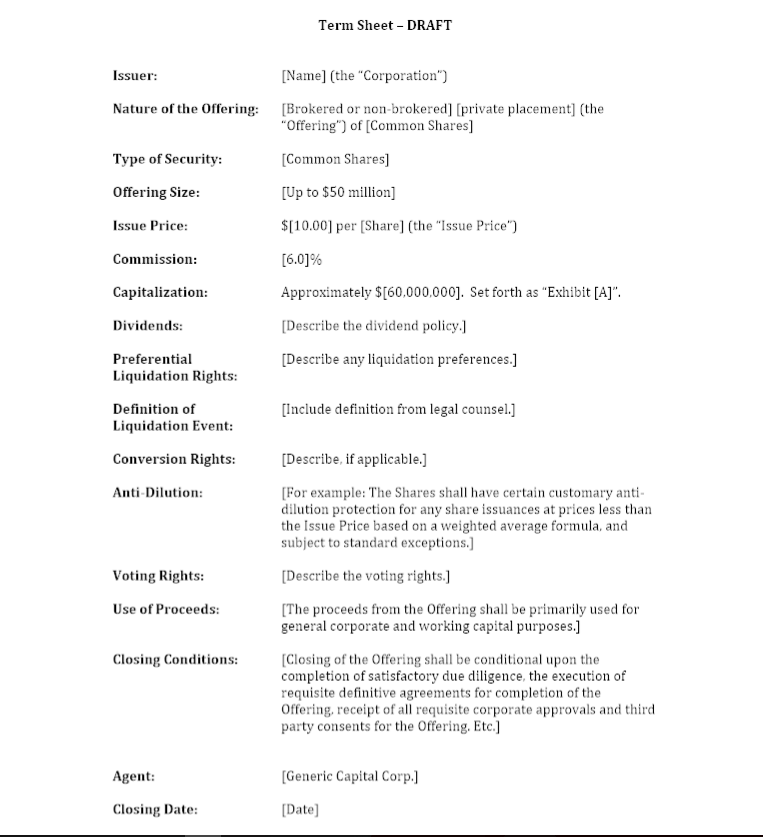

A payment agreement template is an important document which outlines all the terms and conditions of a loan. The principal amount of the loan together with accrued interest shall be repayable on september 30 2009. The term sheet of bank loan template is widely used by big business houses corporate banks and money lenders to define all the terms and conditions that are attached to the deal.

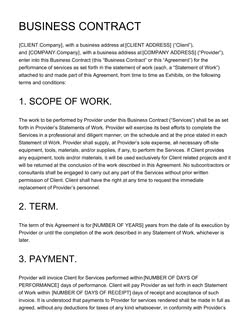

You may heard about loan agreements before a loan is an agreement of borrowing money from the lender and then repay him after a specified time. Its primary function is to serve as written evidence of the amount of a debt and the terms under which it will be repaid including the rate of interest if any. The loan agreement may be in writing or in oral the writing loan agreement is fully legal and it binds the borrower in the terms and conditions of loans.

It covers issues like the agreement party details the terms and conditions of the loan and warranty information. You are loaning money to someone and want a signed agreement. You can easily customize the headers adjust the sections or make changes in the layout to ensure that your bank loan template gets signed by both the parties and.

10000000 the loan by way of loan to the borrower upon and subject to the terms and conditions contained in this loan agreement. You are borrowing money and want to show that you agree to repay. So its important to document all these relevant information.

When should i use a loan agreement. When you borrow money you and your lender agree to specific conditionsthe terms of your loan. Information such as the periods of payment the amounts and the interest rates are essential to the loan agreement.

A loan agreement is a written evidence of a loan between individual persons or entities such as partnerships and corporationsit contains the amount of the debt and the terms and conditions of the loan. If you want to give equipments on loan to users this example template can help you along. Acceleration a clause within a loan agreement that protects the lender by requiring the borrower to pay off the loan both the principal and any accumulated interest immediately if certain conditions occur.

0 Response to "Loan Terms And Conditions Template"

Post a Comment