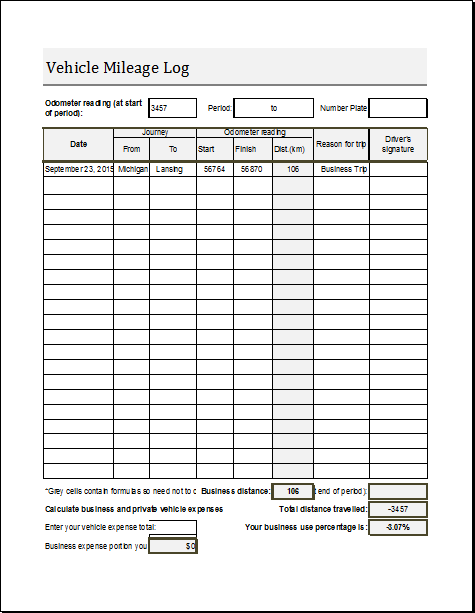

The mileage deduction is a deduction that enables the self employed to write off business mileage. Template features include sections to list starting and ending locations daily and total miles driven employee information and approval signatures.

The date on which the trip started should be mentioned along with the date on which it was ended.

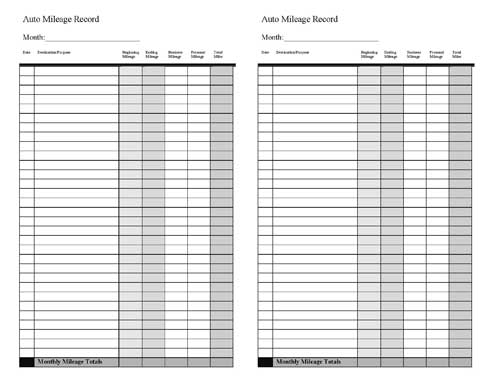

Monthly mileage log template. Mileage log and expense report. Report your mileage used for business with this log and reimbursement form template. What is a mileage log.

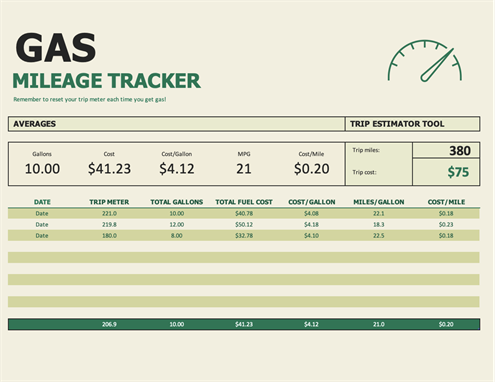

Download this free excel mileage log to manually keep track of your miles. To claim deductions on your tax returns you have to keep meticulous records of your driving. This monthly mileage report template can be used as a mileage calculator and reimbursement form.

The organizations develop a template or use an already available ready made format from the online sources or programs such as microsoft excel and customize them to track and record the mileage details. Mileage and reimbursement amounts are calculated for you to submit as an expense report. In this case it would be the name of the month.

Many people record the time weekly or monthly which will not satisfy the irs if theres an audit of your recordsthe easiest way to keep records is to use a mileage log template that will have spaces for you to record your mileage for each trip you take. What is the mileage deduction. We have you covered.

Furthermore now there are many mileage applications as well in which one can easily record the mileage details on the go. A typical monthly mileage log consists of a few details like the time period to which the log relates. Looking for a mileage log template for excel.

0 Response to "Monthly Mileage Log Template"

Post a Comment